[ I know most of the payments experts in the community will already be familiar with the things that I have been excited to learn. Still I hope the short anecdotes about my learning will be in some way encouraging and even mildly amusing to some. ]

Arrival and Lunch

After the recent Mojaloop conference in Kigali my wife (Jill) and I had the wonderful opportunity to visit friends in Uganda both in Kampala and in the North in the Kamwenge district in a little village called Kibogo. We also slotted in a nice side trip to Queen Elizabeth Park (QEP) for a boat ride and safari, a trip which itself taught us a surprising amount about the Ugandan mobile payments landscape.

Upon arriving in Entebbe , our friends from Kampala picked us up and we stopped on the way back to their place for lunch at a pretty modern shopping centre (mall). The mobile money signs were everywhere including at the restaurant could pay for your lunch with MTN or seemingly to me less commonly Airtel. Ahh I thought, now all those conference sessions on merchant payments made sense to me (thanks Paul M), so too did the limitations become immediately obvious , for instance what if the restaurant had MTM but I used Airtel , then out with the cash it is. Well usually that is what happens, but as we were (are) muzungu and because this restaurant chain was large enough and as we had not yet visited the ATM then it was out with the mastercard. In fact it turns out that we could use our mastercard or visa credit card at malls like this , at some service stations (gas stations for those that speak USA) at electronics shops and various tourist spots including Songbird Safari Lodge near QEP (you should go there!). However even as I used our mastercard I was very conscious of what I had learned from the wonderful "walk the loop" session at the Mojaloop Zanzibar conference which was that using mastercard was a significant cost to these businesses and to Uganda (up to 10% if I understand correctly what the various Ugandan vendors told me during our visit).

So with the lunch bill paid by mastercard, it was "off to the ATM" where we learned the next lesson about the Uganda monetary system and that is , when you need cash you need a "lot" of individual notes and these notes are very unwieldy / bulky to cart around on you. It demonstrated very quickly a significant reason why mobile money was both popular and important for Uganda i.e. it lessened significantly the "amount" of cash you needed to carry.

Broad eco-system observations and MTN costs

Overall from our friends in Kampala we learned that the Uganda economy worked very much off of both mobile money payments and cash, with the current limitations of mobile money ensuring that cash still dominates. Our friends would pay their mobile phone airtime and data using with mobile money and I believe rent and a variety of other services , but when they ordered pizza the only choice was to pay the delivery driver with cash. Certainly my biggest surprise here was not having to use cash, rather getting offered home delivery pizza in Kampala !

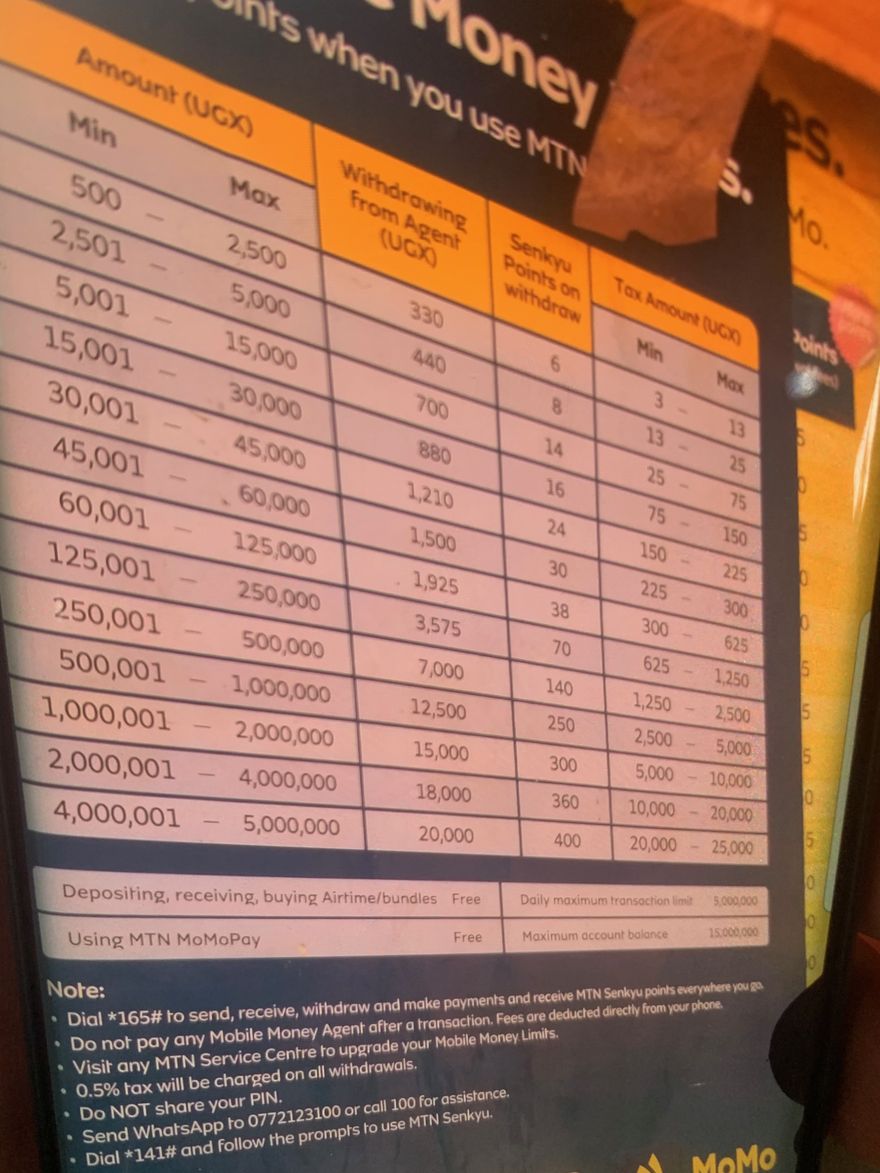

One thing that became obvious very quickly is friends helping each other out with small loans, so that instant mobile payments from one person to another are very common and it turns out cost nothing. The costs to the user are largely incurred when cash is withdrawn from the wallet (see photo below detailing costs). Indeed it appears that the mobile money companies themselves commonly allow small short-term loans to their customers although there is of course a cost to this.

You can see from the photo below detailing MTN mobile money costs that transfers and deposits are free but that withdrawals incur charges and tax. The structure of the charges appears designed to promote adoption and use of the service and that makes a lot of sense. Still it made me wonder what the scale and structure of the charges might become in the future when uptake is greater, which also implies that Mojaloop could have an important role in ensuring competition between vendors and keeping prices and charges down medium and long term.

Oh I should point out that Jill was wonderfully patient and even at times interested in my many payment and money related questions of our friends, of serving staff , small business owners we encountered and especially our wonderful driver (and new friend) for the week Cyrus.

TBC : In part #2 I plan to write about our road trip to Kibogo and QEP including our brush with the Ugandan police that involves a fascinating real-world mobile-money story.

Top comments (0)